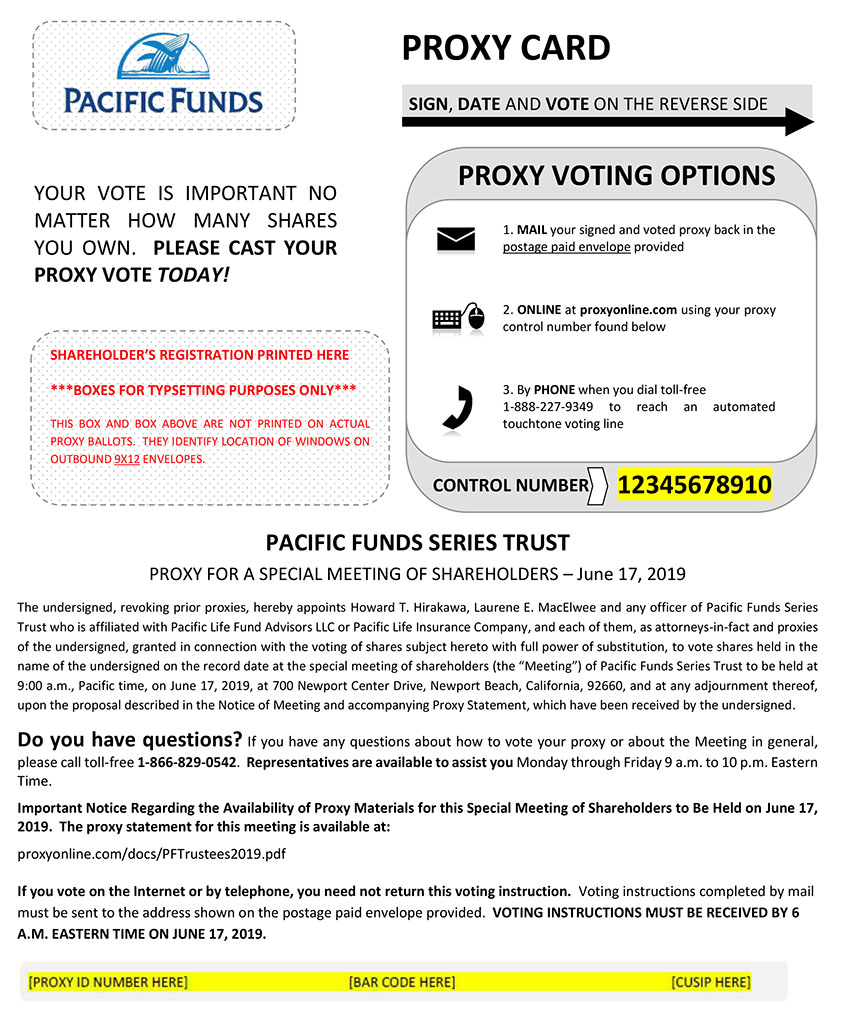

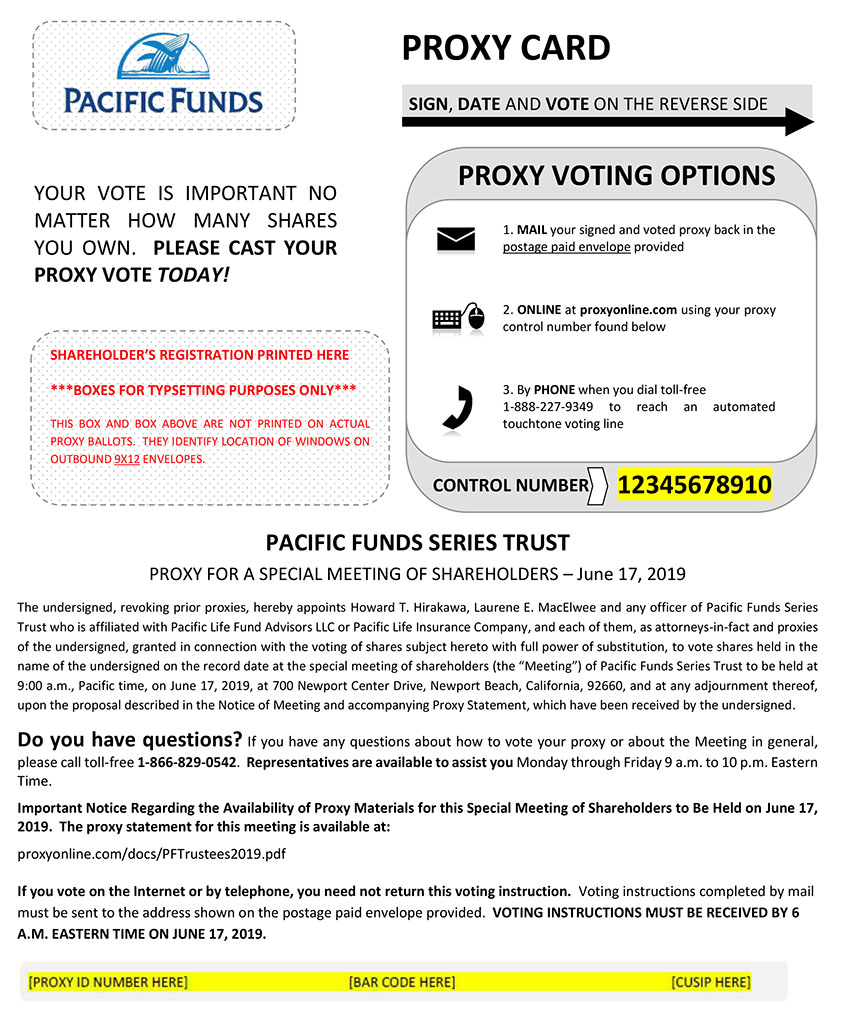

Please respond—your vote is important. Meeting.Whether or not you plan to attend the Meeting, please vote promptly by completing, signing and returning the enclosed voting instruction proxy card promptly, calling the number listed on the proxy card or logging onto the website listed on your proxy card and following the instructions. Whether by mail, telephone or Internet. IfInternet, voting instructions must be received by 6 a.m. Eastern time on June 17, 2019 to be counted.

The Board unanimously recommends that you do not vote a proxy solicitation service may call you to remind you to vote.“For All” of the Nominees.

Please respond — your vote is important.

By Order of the Board of Trustees,

Jane M. Guon

Vice President and Secretary

Pacific Funds Series Trust

April 29, 2019

| |

| By Order of the Board of Trustees |

|

| -s- Audrey L. Milfs |

| Audrey L. Milfs, |

|

| Secretary |

|

Newport Beach, California

February 4, 2008

| |

* | The Portfolio Optimization Funds include the PL Portfolio Optimization Conservative, PL Portfolio Optimization Moderate-Conservative, PL Portfolio Optimization Moderate, PL Portfolio Optimization Moderate-Aggressive and PL Portfolio Optimization Aggressive Funds. |

PROXY STATEMENT

PACIFIC LIFE FUNDS

700 Newport Center Drive

Newport Beach, California 92660

FORSPECIAL MEETING OF SHAREHOLDERS OF

THE PACIFIC LIFE FUNDS’ PORTFOLIO OPTIMIZATION FUNDS SERIES TRUST

on March 25, 2008

SOLICITATION OF PROXIESTO BE HELD ON BEHALF OF THE

BOARD OF TRUSTEES OF PACIFIC LIFE FUNDS

JUNE 17, 2019INTRODUCTION

This proxy statement (the“Proxy Statement”) is being furnished to you in connection with the solicitation of proxies by the Board of Trustees (the“Board” or“Board of Trustees”) of Pacific Funds Series Trust (the“Trust”) on behalf of all of its series (the“Funds”) to be voted at a special meeting (the“Meeting”) of shareholders of the Trust to be held on June 17, 2019. This Proxy Statement is first being mailed to shareholders on or about April 29, 2019.

PLEASE read this entire Proxy Statement carefully, including the Appendices.

PROPOSAL – ELECTION OF THREE TRUSTEES TO THE BOARD OF TRUSTEES

Which shareholders are voting on this proposal?

Shareholders of all Funds.

What are shareholders being asked to approve?

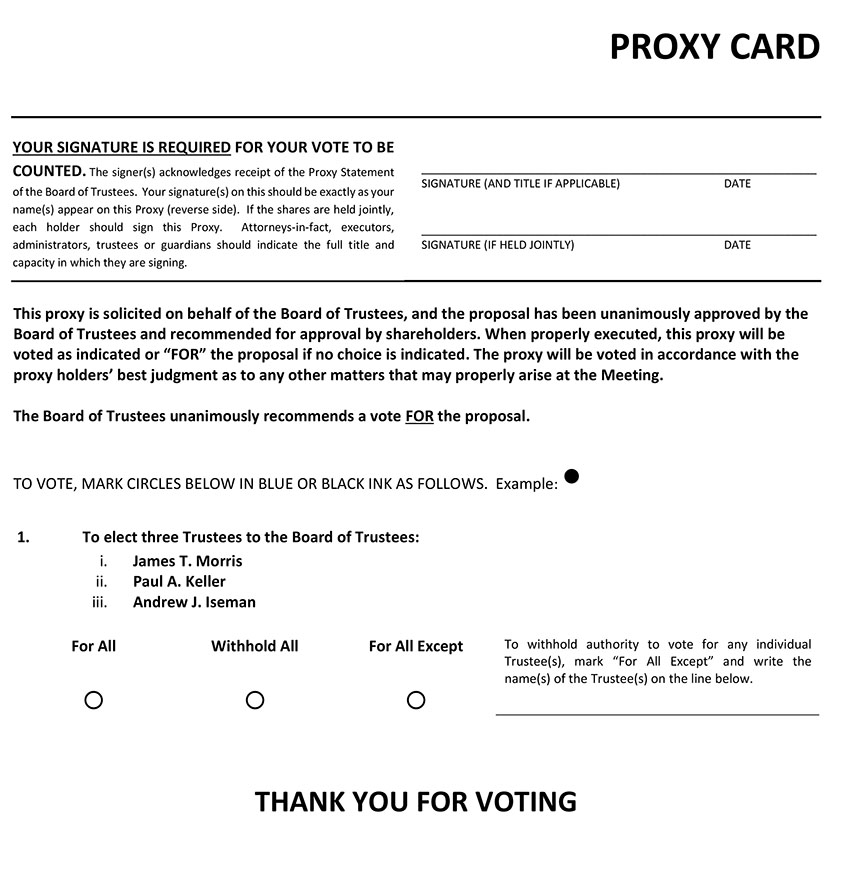

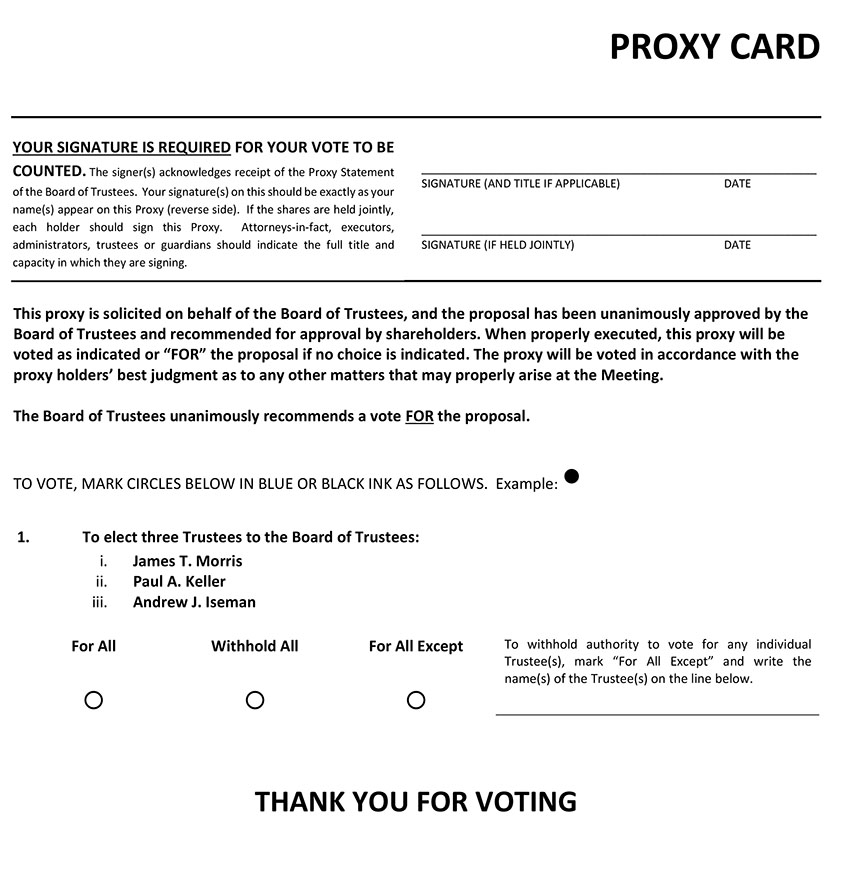

Shareholders are being asked to elect three Trustees to the Board of Trustees of the Trust: (i) James T. Morris, (ii) Paul A. Keller and (iii) Andrew J. Iseman (the“Nominees”).

Mr. Morris and Mr. Keller currently serve as Trustees of the Trust. Mr. Iseman has been nominated but does not yet serve as a Trustee of the Trust. If shareholders approve the proposal, the elections would be effective June 18, 2019.

Why are shareholders being asked to elect the three Trustees?

The Board currently has five Trustees: James T. Morris, Gale K. Caruso, Paul A. Keller, Lucie H. Moore and Nooruddin (Rudy) Veerjee. Three of the five Trustees have been elected by shareholders (Ms. Moore in 2001 and Mr. Veerjee and Ms. Caruso in 2005, effective in 2006). Messrs. Morris and Keller were appointed by the Board (Mr. Morris in 2007 and Mr. Keller in 2016) to fill vacancies on the Board, but have not been elected by shareholders. At the Board’s December 12, 2018 meeting, the Board nominated Mr. Iseman to serve as a Trustee, effective upon his election by shareholders, and he has consented to serve as a Trustee upon his election. Mr. Iseman, if elected by shareholders, would also fill an existing vacancy on the Board.

Under the Investment Company Act of 1940, as amended (the“1940 Act”), a vacancy on a mutual fund board may be filled without shareholder approval only if, upon filling the vacancy, at least two-thirds of the board members have been approved by shareholders.

Mr. Iseman cannot begin to serve as a Trustee until his appointment is approved by shareholders because, without such approval, only three of the six Trustees (less than the two-thirds requirement) would have been elected by shareholders. Accordingly, shareholders are being asked to elect Mr. Iseman.

Also at the Board’s December 12, 2018 meeting, Messrs. Morris and Keller were asked to stand for election so that all of the members of the Board will have been elected by shareholders, and they consented to continue to serve if elected. Although they already serve on the Board, having Messrs. Morris and Keller be elected by shareholders is important because it will give the Board more flexibility to appoint a limited number of additional new Trustees if necessary without incurring the high costs of holding shareholder meetings to elect new Trustees. Accordingly, shareholders are also being asked to elect Messrs. Morris and Keller.

What is the Board structure and what are the qualifications of the Trustees and Nominees?

Four of the five current Trustees are Independent Trustees, meaning they are not “interested persons” of the Trust as defined in the 1940 Act. Mr. Morris is a Management Trustee, meaning he is an “interested person” of the Trust due to his position as Chairman, Chief Executive Officer (“CEO”) and President of Pacific Life Insurance Company (“Pacific Life”), which is the parent of the Trust’s investment adviser, Pacific Life Fund Advisors LLC (the“Adviser” or“PLFA”). At the Board’s January 11, 2007 meeting, during which it was noted that the Board’s Policy Committee had discussed succession to the Chairmanship of the Board and the relationship of the Chairman with Pacific Life’s management personnel, the Board of Trustees voted unanimously to appoint Mr. Morris to serve as Chairman of the Board of Trustees, (the “Board”Chief Executive Officer and Trustee of the Trust.

The Trust’s Governance Committee, which consists solely of Independent Trustees, engaged in an extensive and deliberative process to identify and evaluate potential candidates to serve as an Independent Trustee of the Trust. After carefully reviewing and considering the qualifications, experience and background of potential candidates, which included conducting interviews with certain candidates, the Governance Committee determined at its September 16, 2015 meeting to recommend the appointment of Mr. Keller as a Trustee of the Trust. At the Board’s September 17, 2015 meeting, based upon the Governance Committee’s recommendation and additional discussion, the Board of Trustees voted unanimously to appoint Mr. Keller to serve as a Trustee of the Trust. After carefully reviewing and considering the qualifications, experience and background of potential candidates, which included conducting interviews with certain candidates, the Governance Committee determined at its September 25, 2018 meeting to recommend the nomination of Mr. Iseman as a Trustee of the Trust. At the Board’s December 12, 2018 meeting, based upon the Governance Committee’s recommendation and additional discussion, the Board of Trustees voted unanimously to nominate Mr. Iseman to serve as a Trustee of the Trust, subject to election by shareholders. In evaluating candidates, the Governance Committee takes into account all factors it considers relevant, including without limitation, experience, demonstrated capabilities, independence, commitment, reputation, background, diversity, understanding of the investment business and understanding of business, legal and financial matters generally. A copy of the Trust’s Governance Committee Charter, which includes additional factors that may be considered by the Governance Committee members when evaluating potential candidates, is set forth inExhibit A.

Term of Office for Trustees

Once duly appointed or elected, Trustees serve for an indefinite term until their retirement, resignation, removal, or death, or until their successor is duly elected. The Trust’s Governance Committee has adopted an Independent Trustee retirement policy that fixes a mandatory retirement date for the Independent Trustees of December 31 of the year in which the Independent Trustee reaches the age of 74.

Professional Background of Trustees and Nominees

The Governance Committee conducts a “self-assessment” annually to review the effectiveness of the Board and its committees. In conducting its annual self-assessment at its September 25, 2018 meeting, the Governance Committee determined that the current Trustees have the appropriate attributes and experience to continue to serve effectively as Trustees of the Trust. The Board believes that each of the current Trustees and Nominees has the qualifications, experience, attributes and skills (“Trustee Attributes”) appropriate for service as a Trustee in light of the Trust’s business and structure. Each has a demonstrated record of business and/or professional accomplishment.

The following table shows information about the three Nominees who are standing for election at the Meeting, as well as the Trustees who are not standing for election at this time, but are expected to remain on the Board following the Meeting.

Management Trustee and Nominee

| Name and Age | Position(s) with the Trust and Length of Time Served | Current Directorship(s) Held and

Principal Occupation(s) During Past 5 Years | Number of Funds in

Fund Complex Overseen1 |

James T. Morris

Year of birth 1960 | Chairman of the Board and Trustee since 1/11/07 Standing for Election | Director (4/07 to present), Chairman (5/08 to present), Chief Executive Officer (4/07 to present) and President (1/16 to present) of Pacific Mutual Holding Company and Pacific LifeCorp; Director (4/07 to present), Chairman (5/08 to present), Chief Executive Officer (4/07 to present) and President (1/16 to present) of Pacific Life; Chief Executive Officer (5/07 to 10/15) and President (5/07 to 3/12) of Pacific Life Fund Advisors LLC; Director (4/16 to present) of Edison International (a public utility holding company); and Chairman of the Board and Trustee (1/07 to present) of Pacific Select Fund. | 89 |

Independent Trustees and Nominees

| Name and Age | Position(s) with the Trust and Length of Time Served | Current Directorship(s) Held and

Principal Occupation(s) During Past 5 Years | Number of Funds in

Fund Complex1Overseen |

Gale K. Caruso

Year of birth 1957 | Trustee since 1/01/06 | Trustee (1/06 to present) of Pacific Select Fund; Independent Trustee (2/15 to present) of Matthews Asia Funds. Formerly: Member of the Board of Directors of LandAmerica Financial Group, Inc.; President and Chief Executive Officer of Zurich Life; Chairman, President and Chief Executive Officer of Scudder Canada Investor Services, Ltd.; Managing Director of Scudder Kemper Investments; Member of the Advisory Council to the Trust for Public Land in Maine; Member of the Board of Directors of Make-A-Wish of Maine. | 89 |

Lucie H. Moore

Year of birth 1956 | Trustee since 6/13/01 | Trustee (10/98 to present) of Pacific Select Fund; Member of the Board of Trustees (2014 to present) of Azusa Pacific University; Member of the Board of Trustees (2016 to present) of Pacifica Christian High School Orange County. Formerly: Partner of Gibson, Dunn & Crutcher (Law); Member of the Board of Trustees of Sage Hill School; Member of the Board of Trustees of The Pegasus School; and Member of the Advisory Board of Court Appointed Special Advocates (CASA) of Orange County. | 89 |

Nooruddin (Rudy)

Veerjee

Year of birth 1958 | Trustee since 9/13/05 | Trustee (1/05 to present) of Pacific Select Fund. Formerly: President of Transamerica Insurance and Investment Group; President of Transamerica Asset Management; Chairman and Chief Executive Officer of Transamerica Premier Funds (Mutual Fund); and Director of various Transamerica Life Companies. | 89 |

Paul A. Keller

Year of birth 1954 | Trustee since 6/20/16 and Nominee Standing for Election | Trustee (6/16 to present) of Pacific Select Fund; Consultant to the Trust and Pacific Select Fund (11/15 to 6/16); Independent Trustee (8/10 to present) of Fenimore Asset Management Trust (FAM Funds); Business Consultant (2010 to present) (sole proprietor); Certified Public Accountant in New York (1982 to present); Adjunct Professor of Accounting (2011 to 2015), SUNY College at Old Westbury; Interim Chief Financial Officer (2014 to 2015) of The Leon Levy Foundation. Formerly: Partner of McGladrey & Pullen LLP; Partner of PricewaterhouseCoopers LLP. | 89 |

Andrew J. Iseman Year of birth 1964 | Consultant since 3/1/19 and Nominee Standing for Election | Trustee (3/19 to present) of Pacific Select Fund; Chief Executive Officer (8/10 to 9/18) and Senior Adviser (10/18 to 1/19) of Scout Investments; President (11/10 to 11/17) of Scout Funds; Interested Trustee (4/13 to 11/17) of Scout Funds. | 55 |

| 1 | The “Fund Complex” comprises Pacific Select Fund (55 funds) and the Trust (34 Funds) as of March 31, 2019. |

Additional Qualifications of Trustees and Nominees

In addition to the information provided in the table above, certain additional information regarding the Trustees and Nominees is provided below. The information is not all-inclusive. Many Trustee Attributes involve intangible elements, such as intelligence, integrity and work ethic, along with the ability to work together, to communicate effectively, to exercise judgment and ask incisive questions, and commitment to shareholder interests.

Ms. Caruso, Independent Trustee, has executive experience from her former positions as President and Chief Executive Officer of Zurich Life, Chairman, President and Chief Executive Officer of Scudder Canada Investor Services, Ltd. and Managing Director of Scudder Kemper Investments. Ms. Caruso also has prior insurance company board experience, having previously served as a director of LandAmerica Financial Group, Inc. (an insurance company) and on the board of directors of the Illinois Life Insurance Council as well as prior insurance fund and mutual fund board experience. Ms. Caruso also serves as a trustee of the Matthews Asia Funds (a series of mutual funds).

Ms. Moore, Independent Trustee, has significant legal experience as a former Partner with the law firm of Gibson, Dunn & Crutcher.

Mr. Veerjee, Independent Trustee, has insurance company executive experience as former President of Transamerica Insurance and Investment Group. He also has executive mutual fund and asset management experience as former President of Transamerica Asset Management and as former Chairman and Chief Executive Officer of Transamerica Premier Funds.

Mr. Keller, Independent Trustee, Nominee (standing for election), has financial accounting experience as a Certified Public Accountant and was a former Audit Partner at PricewaterhouseCoopers LLP with over 30 years of experience in the mutual fund industry. Mr. Keller also serves as a trustee of the FAM Funds (a series of mutual funds).

Mr. Iseman, Nominee (standing for election), has significant investment management and executive experience from his former positions as Chief Executive Officer of Scout Investments and President of Scout Funds (a series of mutual funds now known as the Carillon Series Trust). Mr. Iseman also has prior investment company board experience, having previously served as an interested trustee for the Scout Funds and as a consultant for Pacific Funds Series Trust.

Mr. Morris, Management Trustee, Nominee (standing for election), is Chairman, CEO and President of Pacific Life, Funds (the “Trust”) for use at a special meeting of shareholderswhich makes him an “Interested Person” of the following funds:

| | |

|

| • | PL Portfolio Optimization Conservative Fund |

|

|

|

| • | PL Portfolio Optimization Moderate-Conservative Fund |

|

|

|

| • | PL Portfolio Optimization Moderate Fund |

|

|

|

| • | PL Portfolio Optimization Moderate-Aggressive Fund |

|

|

|

| • | PL Portfolio Optimization Aggressive Fund |

|

(each a “Portfolio Optimization Fund”Trust. In these positions, Mr. Morris has intimate knowledge of Pacific Life and collectively,PLFA, its products, operations, personnel, and financial resources. His position of influence and responsibility at Pacific Life, in addition to his knowledge of the “Portfolio Optimization Funds”)

scheduledfirm, has been determined to be

valuable to the Board in its oversight of the Trust.Contact Information

The contact information for each Trustee and Nominee is c/o Pacific Funds Series Trust, 700 Newport Center Drive, Newport Beach, CA 92660.

Executive Officers

The business and affairs of the Trust are managed under the direction of the Board under the Trust’s Agreement and Declaration of Trust (the“Declaration of Trust”). Trust officers are appointed by the Board to oversee the day-to-day activities of each Fund. Information about the officers is set forth inExhibit B.

Leadership Structure and Committees

The Role of the Board. The Board oversees the management and operations of the Trust. Like most mutual funds, the day-to-day management and operation of the Trust is performed by various service providers to the Trust, such as the Adviser, Fund sub-advisers, the distributor, administrator, custodian, and transfer agent. The Board has appointed senior employees of certain of these service providers as officers of the Trust, with responsibility to monitor and report to the Board on the Trust’s operations. The Board receives regular reports from these officers and service providers regarding the Trust’s operations. For example, the Treasurer provides reports as to financial reporting matters and investment personnel report on the performance of the Funds. The Board has appointed a Trust Chief Compliance Officer who administers the Trust’s compliance program and regularly reports to the Board as to compliance matters. Some of these reports are provided as part of formal Board meetings which are typically held quarterly, in person, and involve the Board’s review of recent Trust operations. From time to time, one or more Independent Trustees may also meet with management in less formal settings, between scheduled Board meetings, to discuss various topics. In all cases, however, the role of the Board and of any individual Trustee is one of oversight and not of management of the day-to-day affairs of the Trust and its oversight role does not make the Board a guarantor of the Trust’s investments, operations or activities.

Board Structure, Leadership. The Board has structured itself in a manner that it believes allows it to perform its oversight function effectively. It has established four standing committees, an Audit Committee, a Policy Committee, a Governance Committee and a Trustee Valuation Committee, which are discussed in greater detail under“Committees” below. More than 75% of the members of the Board are Independent Trustees and each of the Audit, Policy and Governance Committees is comprised entirely of Independent Trustees. The Chairman of the Board is the Chairman, CEO and President of Pacific Life. The Board has a Lead Independent Trustee, who acts as the primary liaison between the Independent Trustees and management. The Independent Trustees, including the Lead Independent Trustee, help identify matters for consideration by the Board and the Lead Independent Trustee regularly participates in the agenda setting process for Board meetings. The Lead Independent Trustee serves as Chairman of the Trust’s Policy Committee, which provides a forum for the Independent Trustees to meet in separate session to deliberate on matters relevant to the Trust. The Independent Trustees have also engaged their own independent counsel to advise them on matters relating to their responsibilities in connection with the Trust. The Board reviews its structure annually. In developing its structure, the Board has considered that the Chairman of the Board, as the Chairman, CEO and President of Pacific Life, can provide valuable input as to, among other things, the operation of the Adviser and Pacific Life, their financial condition and business plans relating to the Trust. The Board has also determined that the structure of the Lead Independent Trustee and the function and composition of the Policy, Audit, Governance and Trustee Valuation Committees are appropriate means to provide effective oversight on behalf of the Trust’s shareholders and address any potential conflicts of interest that may arise from the Chairman’s status as an Interested Trustee. The Board met four times during the Funds’ fiscal year ended March 31, 2019. Each of the Trustees attended all meetings of the Board during the fiscal year ended March 31, 2019, and all of the Independent Trustees attended all meetings of the Board, Policy Committee, Audit Committee and Governance Committee held during the fiscal year ended March 31, 2019.

Board Oversight of Risk Management. As part of its oversight function, the Board receives and reviews various risk management reports and assessments and discusses these matters with appropriate management and other personnel. The full Board receives reports from PLFA and Fund sub-advisers as to investment risks as well as other risks that may be also discussed in Policy or Audit Committee. In addition, the Board receives reports from the Adviser’s Risk Oversight Committee regarding its assessments of potential material risks associated with the Trust and the manner in which those risks are addressed. Because risk management is a broad concept comprised of many elements, Board oversight of different types of risks is handled in different ways. For example, the Board and its committees periodically receive reports from Pacific Life and its Chief Risk Officer as to Pacific Life’s enterprise risk management. The Board and its committees also receive periodic reports as to how PLFA conducts service provider oversight and how it monitors for other risks, such as derivatives risk, business continuity risks and risks that might be present with individual Fund sub-advisers or specific investment strategies. The Audit Committee meets regularly with the Chief Compliance Officer to discuss compliance and operational risks. The Audit Committee also meets regularly with the Treasurer, and the Trust’s independent registered public accounting firm and, when appropriate, with other Pacific Life personnel to discuss, among other things, the internal control structure of the Trust’s financial reporting function.

Committees. As noted above, the standing committees of the Board are the Audit Committee, the Policy Committee, the Governance Committee and the Trustee Valuation Committee.

Audit Committee.The members of the Audit Committee include each Independent Trustee of the Trust. The Audit Committee operates pursuant to a separate charter and is responsible for, among other things, reviewing and recommending to the Board the selection of the Trust’s independent registered public accounting firm, reviewing the scope of the proposed audits of the Trust, reviewing with the independent registered public accounting firm the accounting and financial controls of the Trust and the results of the annual audits of the Trust’s financial statements, interacting with the Trust’s independent registered public accounting firm on behalf of the full Board, assisting the Board in its oversight of the Trust’s compliance with legal and regulatory requirements, and receiving reports from the Chief Compliance Officer. Mr. Keller serves as Chairman of the Audit Committee. The Audit Committee met four times during the fiscal year ended March 31, 2019.

Pursuant to its charter, the Audit Committee also serves as the Qualified Legal Compliance Committee for the Trust for purposes of Section 307 of the Sarbanes Oxley Act (“SOX”), regarding standards of professional conduct for attorneys appearing and practicing before the U.S. Securities and Exchange Commission on behalf of an issuer (“Reporting Attorney”). A Reporting Attorney who becomes aware of evidence of a material violation by the Trust, or by any officer, director, employee, or agent of the Trust, may report the matter to the Qualified Legal Compliance Committee as an alternative to the reporting requirements of SOX (which requires reporting to the chief legal officer and potentially “up the ladder” to other entities). The Qualified Legal Compliance Committee must take appropriate steps to respond to any reports received from a Reporting Attorney. The Qualified Legal Compliance Committee meets as necessary during the year. The Qualified Legal Compliance Committee did not meet during the fiscal year ended March 31, 2019.

Policy Committee.The members of the Policy Committee include each Independent Trustee of the Trust. The Policy Committee operates pursuant to a separate charter and its primary responsibility is to provide a forum for its members to meet and deliberate on certain matters to be presented to the Board for its review and/or consideration for approval at 9 a.m. Pacific time onBoard meetings. Mr. Veerjee serves as Chairman of the Policy Committee. The Policy Committee met five times during the fiscal year ended March 25, 2008 (the “Meeting”)31, 2019.

Governance Committee.The members of the Governance Committee include each Independent Trustee of the Trust. The Governance Committee operates pursuant to a separate charter and is responsible for, among other things, the Trustees’ “self-assessment,” making recommendations to the Board concerning the size and composition of the Board, determining compensation of the Independent Trustees, establishing an Independent Trustee retirement policy and the screening and nomination of new candidates to serve as Trustees.

With respect to new Trustee candidates, the Governance Committee may seek candidate referrals from a variety of sources and may engage a search firm to assist it in identifying or evaluating potential candidates. The Governance Committee will consider any candidate for Trustee recommended by a current shareholder if such recommendation contains sufficient background information concerning the candidate to enable the Governance Committee to make an informed judgment as to the candidate’s qualifications. The recommendation must be submitted in writing and addressed to the Governance Committee Chairperson at the offices ofTrust’s offices: Pacific Funds’ Governance Committee, c/o Pacific Life Fund Advisors LLC, (“PLFA”), located at 700 Newport Center Drive, Newport Beach, CA 92660, and at any adjournmentAttention: Governance Committee Chairperson. Ms. Moore serves as Chairperson of the Meeting, for the purposes set forth in the accompanying Notice of Special Meeting of Shareholders (“Notice”). This proxy statement will be first mailed to shareholders of the Portfolio Optimization Funds (“Shareholders”) on or about February 4, 2008.Governance Committee. The primary purpose of the Meeting is for Shareholders to consider and approve the following proposals to be effective on or about July 1, 2008:

| | |

|

| (1) | To amend the fee schedule to the Investment Advisory Agreement relating to the Portfolio Optimization Funds to implement an annual advisory fee of 0.20% of average daily net assets of each Portfolio Optimization Fund, which, upon implementation of the new advisory fee will be accompanied by: (i) an equivalent decrease in the annual advisory fee paid by each of the underlying Pacific Life Funds of the Trust in which the Portfolio Optimization Funds currently invest (each an “Underlying Fund” and collectively the “Underlying Funds”); (ii) a 0.05% decrease in the annual administration fee paid to the Trust’s administrator that is applied to the average daily net assets of each of the Portfolio Optimization Funds and each Underlying Fund; (iii) an extension of contractual expense caps through June 30, 2009 for the Portfolio Optimization Funds and Underlying Funds; and (iv) an additional 0.20% decrease in the annual advisory fee that is applied to the average daily net assets for the PL Small-Cap Growth Fund. |

|

|

| (2) | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

1

PROPOSAL 1: Approval of an amendment to the fee schedule to the Investment Advisory Agreement relating to the Portfolio Optimization Funds to implement an annual advisory fee of 0.20% of average daily net assets of each Portfolio Optimization Fund, which, upon implementation of the new advisory fee by each Portfolio Optimization Fund will be accompanied by: (i) an equivalent decrease in the annual advisory fee paid by each of the Underlying Funds; (ii) a 0.05% decrease in the annual administration fee paid to the Trust’s administrator that is applied to the average daily net assets of each of the Portfolio Optimization Funds and each Underlying Fund; (iii) an extension of contractual expense caps through June 30, 2009 for the Portfolio Optimization Funds and Underlying Funds; and (iv) an additional 0.20% decrease in the annual advisory fee that is applied to the average daily net assets for the PL Small-Cap Growth Fund.

At its meeting on December 4, 2007, the Board, including a majority of trustees who are not “interested persons” of the Trust (the “Independent Trustees”), as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), approved an amendment to the fee schedule to the Investment Advisory Agreement between the Trust and PLFA for each of the Portfolio Optimization Funds (the “Amended Agreement”). Shareholders of each Portfolio Optimization Fund are being asked to approve the Amended Agreement as to that fund. Shareholders of each Portfolio Optimization Fund will vote separately on this proposal. If the required Shareholder approval for any Portfolio Optimization Fund is not obtained, the current investment advisory agreement (the “Current Agreement”) will remain in effect for all Portfolio Optimization Funds and there will be no implementation of an advisory fee for any Portfolio Optimization Fund.

Under the Amended Agreement, each Portfolio Optimization Fund will be charged an annual advisory fee equal to 0.20% of its average daily net assets. Upon implementation of the new advisory fee, management will simultaneously decrease the annual advisory fee of the Underlying Funds by 0.20%, decrease the annual administration fee paid to the Trust’s administrator by 0.05% that is applied to the average daily net assets of each of the Portfolio Optimization Funds and Underlying Funds (collectively, the “Funds”), extend the contractual expense caps through June 30, 2009 for the Funds and decrease the annual advisory fee by an additional 0.20% that is applied to the average daily net assets for the PL Small-Cap Growth Fund. Consequently, the total fees and expenses borne directly and indirectly by Shareholders of the Portfolio Optimization Funds will remain substantially the same after the restructuring, and may result in some modest reductions for all the Portfolio Optimization Funds, other than the PL Portfolio Optimization Conservative Fund, due to their investment in the PL Small-Cap Growth Fund and the proposed decrease in the PL Small-Cap Growth Fund’s advisory fee. The reduction in the administration fee will not result in a reduction in the total fees and expenses paid by Shareholders at this time because PLFA is currently reimbursing the Funds for certain expenses pursuant to the current contractual expense cap agreement.

The proposed decrease in the advisory fee for the Underlying Funds, as well as the proposed decrease in the administration fee, extension of the contractual expense caps and the proposed additional 0.20% decrease in the advisory fee for the PL Small-Cap Growth Fund are all contingent on the implementation of the 0.20% advisory fee for the Portfolio Optimization Funds. In the event that Shareholders do not approve the proposal to implement the advisory fee for the Portfolio Optimization Funds, there will be no corresponding decrease in the advisory fee of the Underlying Funds; and there may be no decrease in the administration fee paid to the Trust’s administrator by the Funds, no extension of the contractual expense caps through June 30, 2009 for the Funds and no additional decrease in the advisory fee paid to PLFA by the PL Small-Cap Growth Fund.

Background

The Trust is organized as a Delaware statutory trust. Its business and affairs are overseen by its Board. The shares of the Trust are currently divided into 22 series, including the Portfolio Optimization Funds. Each series currently offers Class A, Class B, and Class C shares except for the PL Money Market, PL Small-Cap Value, PL Main Street Core and PL Emerging Markets Funds, which only offer Class A shares. The Portfolio Optimization Funds also offer Class R shares. Each class represents ownership of the same series, but is subject to different types and levels of sales charges and distribution and/or services fees.

2

The Portfolio Optimization Funds are “fund of funds,” meaning that they seek to achieve their investment objective by investing primarily in the Underlying Funds, excluding other Portfolio Optimization Funds. Each Portfolio Optimization Fund is designed for investors with a particular time horizon or risk profile, and invests in a distinct mix of Underlying Funds. PLFA uses an asset allocation process to determine the Portfolio Optimization Funds’ investment mix. Each Portfolio Optimization Fund invests in Class A shares of certain Underlying Funds, without payment of a front-end sales charge, based on its target allocation percentages.

It is anticipated that on or about June 20, 2008 the Class B and C shares of each series except the Portfolio Optimization Funds will be converted to Class A shares of the corresponding series. This conversion will have no impact on the Portfolio Optimization Funds since they invest only in Class A shares of each series.

PLFA serves as investment adviser to the Portfolio Optimization Funds and the Underlying Funds. Currently, PLFA charges no fee for providing investment advisory services under the Current Agreement with respect to the Portfolio Optimization Funds. The Portfolio Optimization Funds indirectly bear the fees paid by the Underlying Funds in which they invest. These fees include investment advisory fees paid by the Underlying Funds to PLFA. Each of the Underlying Funds has a specific investment objective and strategy. Except for one of the Underlying Funds, PLFA and each of the Underlying Funds have hired various investment sub-advisers to manage theday-to-day investment operations of the Underlying Funds. PLFA pays the fees of the investment sub-advisers. PLFA became the adviser to the Trust on May 1, 2007. Prior to that, Pacific Life Insurance Company (“Pacific Life”) served as the adviser to the Trust. Accordingly, references in this proxy to “Adviser” refer to Pacific Life prior to May 1, 2007 and to PLFA effective May 1, 2007 and thereafter.

Rationale for Implementation of an Advisory Fee

The proposed advisory fee for the Portfolio Optimization Funds and corresponding decrease in the advisory fee of the Underlying Funds reflect a re-evaluation and re-positioning of the Portfolio Optimization Funds as the primary offering of the Trust as well as changes in competitive circumstances. The Trust commenced operations on October 1, 2001 with individual funds and no Portfolio Optimization Funds. The Portfolio Optimization Funds began operations on December 31, 2003 and have accumulated nearly $1.3 billion in assets under management through September 30, 2007. Currently, more than 95% of the total assets of the Trust are within the Portfolio Optimization Funds. This percentage can be expected to increase over time as the Underlying Funds are generally no longer open to new direct investment.

By way of background, in 2006 management re-examined the product offering strategy and focus of the Trust. Given the tremendous growth in demand for asset allocation “fund of funds” over the past several years, and the success of the Portfolio Optimization Funds, management decided to concentrate its efforts on the Portfolio Optimization Funds. This was a significant departure from the way in which the Trust had formerly been distributed and presented to the public. As a result, management sought and obtained approval from the Board to close the Underlying Funds (with the exception of the PL Money Market Fund) to new investors. Since that time, shares of the Underlying Funds may be sold only to the Portfolio Optimization Funds (existing shareholders of the Underlying Funds may also purchase additional shares of the Underlying Funds which they currently hold). This structural change was made with the goal of offering and marketing the Trust as true asset allocation “fund of funds” in which only the Portfolio Optimization Funds would be offered to the public and the Portfolio Optimization Funds, in turn, would invest all of their assets in various Underlying Funds in accordance with the investment objectives and strategies of each particular Portfolio Optimization Fund.

While the Portfolio Optimization Funds were initially structured without an advisory fee at the “fund of funds” level or “asset allocation” level, PLFA’s recent research has confirmed that the Portfolio Optimization Funds’ competitors charge advisory fees at the asset allocation level. In addition, PLFA performs significant advisory services for the Portfolio Optimization Funds at the asset allocation level. These advisory services include the following, among others: (i) evaluating the analysis provided by the asset allocation consulting

3

firm and implementing the target allocations; (ii) allocation of daily cash flows to the asset allocation models; (iii) monitoring deviations from the target allocations; and (iv) monitoring the performance of the Portfolio Optimization Funds. PLFA incurs material expenses for the advisory services provided to the Portfolio Optimization Funds at the asset allocation level. These expenses include personnel, maintaining investment advisory processes, research, including the costs of retaining an asset allocation consulting firm, as well as the cost of other internal resources. Given the results of PLFA’s research, coupled with the fact that PLFA performs advisory services and incurs advisory expenses at the Portfolio Optimization Funds level, management determined to recommend the restructuring. At the same time, management was sensitive to the need that the restructuring not result in an increase in the fees and expenses paid by Shareholders.

As a result, management recommended, and the Trustees approved, a proposal that the Trust implement an annual advisory fee of 0.20% of average daily net assets for each Portfolio Optimization Fund. This fee would recognize the advisory functions performed by PLFA for the Portfolio Optimization Funds and better reflect the “fund of funds” nature of the Trust. In order that Shareholders do not experience an increase in the expenses paid in connection with their investment, PLFA has agreed, subject to approval and implementation of the new advisory fee, to simultaneously decrease the advisory fees of the Underlying Funds by 0.20%; and PLFA is willing to decrease the annual advisory fee it receives with respect to the PL Small-Cap Growth Fund by an additional 0.20% that is applied to the average daily net assets for the fund. Consequently, the total fees and expenses borne directly and indirectly by Shareholders of the Portfolio Optimization Funds will remain substantially the same after the restructuring, and may result in some modest reductions for all the Portfolio Optimization Funds, other than the PL Portfolio Optimization Conservative Fund, due to their investment in the PL Small-Cap Growth Fund and the proposed decrease in the PL Small-Cap Growth Fund’s advisory fee. The small minority of shareholders in the Underlying Funds that are not investing through a Portfolio Optimization Fund would receive a 0.20% reduction in the fees charged to them by the Underlying Funds (0.40% in the case of the PL Small-Cap Growth Fund). In addition, subject to implementation of the new advisory fee, the Trust’s administrator is willing to permanently lower the annual administration fee from 0.35% to 0.30% of the Fund’s average daily net assets, although this reduction will not result in a reduction in the total fees and expenses paid by Shareholders at this time because PLFA is currently reimbursing the Funds for certain expenses pursuant to the current contractual expense cap agreement. Currently, under the expense cap agreement, the Fund’s administrator is temporarily waiving 0.05% of its administrative fee.

In addition to the above noted fee reductions, PLFA has contractually agreed to reduce its fees or otherwise reimburse each Fund for its operating expenses (including organizational expenses, but not including: any advisory fees, distribution and service(“12b-1”) fees; non12b-1 service fees; interest; taxes (including foreign taxes on dividends, interest and gains); brokerage commissions and other transactional expenses; extraordinary expenses such as litigation and other expenses not incurred in the ordinary course of each fund’s business) that exceed an annual rate based on a percentage of a fund’s average daily net assets. The expense cap for the Portfolio Optimization Funds is currently 0.00% and applies to the direct fees and expenses of the Portfolio Optimization Funds (and not to the indirect fees and expenses of the Underlying Funds); and the expense cap is currently 0.30% for the Underlying Funds. The fee waiver and expense caps are currently being implemented through temporary waiver and expense cap agreements, which terminate on June 30, 2008. If the new advisory fee is approved and implemented, PLFA has agreed to extend the contractual expense caps through June 30, 2009.

The Trust’s Board and PLFA believe it is essential that the restructuring not increase fees and expenses to Shareholders investing in the Portfolio Optimization Funds. Accordingly, and solely for the purpose of achieving this objective, PLFA has agreed to reduce the advisory fees of the Underlying Funds by the same amount of the advisory fee of the Portfolio Optimization Funds. If the proposal to implement the advisory fee for the Portfolio Optimization Funds is approved and the Amended Agreement is implemented, the Administration and Shareholder Services Agreement (the “Administration Agreement”) would also be amended to reduce the administration fee from 0.35% to 0.30% of the Trust’s average daily net assets; and a new expense cap agreement extended through June 30, 2009 will be executed. A copy of the amendment to the Administration Agreement and a copy of the new expense cap agreement will be filed with the Trust’s registration statement after they are executed. Once filed, these documents may be viewed on the Securities

4

and Exchange Commission (“SEC”) website or obtained, along with the Trust’s complete registration statement, from the SEC at: Public Reference Room of the SEC, 100 F Street, N.E., Washington, D.C.20549-01021; Internet:www.sec.gov; and e-mail:publicinfo@sec.gov. The SEC may charge for copies of documents.

Based on the considerations discussed below, the Board approved PLFA’s recommendation and recommends that Shareholders also approve the proposal to implement the advisory fee for the Portfolio Optimization Funds.

Terms of the Amended Agreement

The form of the Amended Agreement and the Current Agreement are included as Appendix A to this Proxy Statement and the description of terms of the Amended Agreement in this section is qualified in its entirety by reference to Appendix A. Except for the proposed implementation of an advisory fee for the Portfolio Optimization Funds, the terms of the Current Agreement and the Amended Agreement are identical and are described below under “Description of the Current and Amended Agreements.” PLFA has represented to the Trustees that the level of advisory and administrative services currently being provided to the Funds will remain the same under the Amended Agreement.

The following table sets forth for each Portfolio Optimization Fund and Underlying Fund (based on each Fund’s average daily net assets): (1) the current annual advisory fee rate; (2) the new annual advisory fee rate, assuming the proposal is approved and implemented; (3) the current annual administration fee rate; and (4) the new annual administration fee rate, assuming the proposal is approved and implemented.

| | | | | | | | | | | | | | | | | |

| | | | | New Advisory Fee | | | | | New Administration | |

| | | Current | | | (if Proposal is | | | Current | | | Fee (if Proposal | |

| | | Advisory | | | Approved and | | | Administration | | | is Approved and | |

| Fund | | Fee | | | Implemented) | | | Fee | | | Implemented)* | |

| | | | | | | | | | | | | |

| PL Portfolio Optimization Conservative | | | 0.00% | | | | 0.20% | | | | 0.35% | | | | 0.30% | |

| PL Portfolio Optimization Moderate-Conservative | | | 0.00% | | | | 0.20% | | | | 0.35% | | | | 0.30% | |

| PL Portfolio Optimization Moderate | | | 0.00% | | | | 0.20% | | | | 0.35% | | | | 0.30% | |

| PL Portfolio Optimization Moderate-Aggressive | | | 0.00% | | | | 0.20% | | | | 0.35% | | | | 0.30% | |

| PL Portfolio Optimization Aggressive | | | 0.00% | | | | 0.20% | | | | 0.35% | | | | 0.30% | |

| PL Money Market | | | 0.40% | | | | 0.20% | | | | 0.35% | | | | 0.30% | |

| PL Small-Cap Value | | | 0.95% | | | | 0.75% | | | | 0.35% | | | | 0.30% | |

PL Main Street® Core | | | 0.65% | | | | 0.45% | | | | 0.35% | | | | 0.30% | |

| PL Emerging Markets | | | 1.00% | | | | 0.80% | | | | 0.35% | | | | 0.30% | |

| PL Small-Cap Growth | | | 1.00% | | | | 0.60% | ** | | | 0.35% | | | | 0.30% | |

| PL International Value | | | 0.85% | | | | 0.65% | | | | 0.35% | | | | 0.30% | |

| PL Large-Cap Value | | | 0.85% | | | | 0.65% | | | | 0.35% | | | | 0.30% | |

| PL Short Duration Bond | | | 0.60% | | | | 0.40% | | | | 0.35% | | | | 0.30% | |

| PL Growth LT | | | 0.75% | | | | 0.55% | | | | 0.35% | | | | 0.30% | |

| PL Mid-Cap Value | | | 0.85% | | | | 0.65% | | | | 0.35% | | | | 0.30% | |

| PL Large-Cap Growth | | | 0.95% | | | | 0.75% | | | | 0.35% | | | | 0.30% | |

| PL International Large-Cap | | | 1.05% | | | | 0.85% | | | | 0.35% | | | | 0.30% | |

| PL Managed Bond | | | 0.60% | | | | 0.40% | | | | 0.35% | | | | 0.30% | |

| PL Inflation Managed | | | 0.60% | | | | 0.40% | | | | 0.35% | | | | 0.30% | |

| PL Comstock | | | 0.95% | | | | 0.75% | | | | 0.35% | | | | 0.30% | |

| PL Mid-Cap Growth | | | 0.90% | | | | 0.70% | | | | 0.35% | | | | 0.30% | |

| PL Real Estate | | | 1.10% | | | | 0.90% | | | | 0.35% | | | | 0.30% | |

| |

* | Currently, the Trust’s administrator is waiving a substantial portion of the administration fee. Accordingly, the 0.05% decrease in the fee will not result in an immediate reduction in the Funds’ total net operating expenses. |

| |

** | Reflects an additional 0.20% decrease in the advisory fee. |

5

Pursuant to the Current Agreement, PLFA does not receive a fee for investment advisory services with respect to the Portfolio Optimization Funds. Upon approval of the Amended Agreement, PLFA will receive an annual advisory fee of 0.20% from each Portfolio Optimization Fund. The advisory fee is computed separately for each Portfolio Optimization Fund and is stated as an annual percentage of the average daily net assets of that Portfolio Optimization Fund. The following table sets forth for each Portfolio Optimization Fund and the Underlying Funds: (1) the aggregate amount of advisory fees paid to the Adviser under the Current Agreement forGovernance Committee met two times during the fiscal year ended March 31,

2007;2019.Trustee Valuation Committee.The members of the Trustee Valuation Committee consist of any two or more Trustees, at least one of whom is an Independent Trustee of the Trust. The two or more Trustees who serve as the members may vary from meeting to meeting. The Trustee Valuation Committee’s primary responsibility is to oversee the implementation of the Trust’s valuation procedures, including valuing securities for which market prices or quotations are not readily available or are deemed to be unreliable, and (2)to review fair value determinations made by PLFA or a Fund sub-adviser on behalf of the aggregate amount of advisory fees that would have been paid toBoard, as specified in the Adviser forTrust’s valuation procedures adopted by the Board. The Trustee Valuation Committee met one time during the fiscal year ended March 31, 2007 if2019.

Beneficial Interest of Trustees and Nominees in the Amended Agreement had beenFunds

The table below shows the dollar range of equity securities beneficially owned by each Trustee or Nominee as of December 31, 2018 (unless otherwise noted) (i) in effect for that year.

For Fiscal Year Ended 3/31/07

Advisory Fees Paid Under:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Amended Agreement | |

| | | Current Agreement | | | (had it been in effect) | |

| | | | | | | |

| | | Portfolio | | | | | Total | | | Portfolio | | | | | Total | |

| | | Optimization | | | Underlying | | | Advisory | | | Optimization | | | Underlying | | | Advisory | |

| Fund | | Fund | | | Fund | | | Fees | | | Fund | | | Fund | | | Fees | |

| | | | | | | | | | | | | | | | | | | |

| PL Portfolio Optimization Conservative | | $ | 0 | | | $ | 159,764 | | | $ | 159,764 | | | $ | 50,142 | | | $ | 109,622 | | | $ | 159,764 | |

| PL Portfolio Optimization Moderate-Conservative | | $ | 0 | | | $ | 490,557 | | | $ | 490,557 | | | $ | 138,155 | | | $ | 350,683 | | | $ | 488,838 | |

| PL Portfolio Optimization Moderate | | $ | 0 | | | $ | 2,043,023 | | | $ | 2,043,023 | | | $ | 523,324 | | | $ | 1,507,044 | | | $ | 2,030,368 | |

| PL Portfolio Optimization Moderate-Aggressive | | $ | 0 | | | $ | 2,292,916 | | | $ | 2,292,916 | | | $ | 550,289 | | | $ | 1,720,201 | | | $ | 2,270,490 | |

| PL Portfolio Optimization Aggressive | | $ | 0 | | | $ | 976,103 | | | $ | 976,103 | | | $ | 220,807 | | | $ | 741,470 | | | $ | 962,277 | |

Appendix B to this Proxy Statement includes a comparative fee table showing (i) the

fees and expenses of each share class of each Portfolio Optimization Fund for the fiscal year ended March 31, 2007Funds and (ii)

on an aggregate basis, in all registered investment companies overseen by the

pro forma fees and expensesTrustee or to be overseen by the Nominee within the Fund Complex.Name of Trustee or Nominee | Dollar Range of Equity Securities in Funds of the Trust | Aggregate Dollar Range of Equity Securities in the Fund Complex |

| Gale K. Caruso | None | Over $100,000 |

| Paul A. Keller | Pacific FundsSM Portfolio Optimization Growth: $50,001 to $100,000 Pacific FundsSM Portfolio Optimization Aggressive-Growth: $1 to $10,000 Pacific FundsSM Strategic Income: $10,001 to $50,000 Pacific FundsSM Floating Rate Income: $50,001 to $100,000 Pacific FundsSM Diversified Alternatives: $10,001 to $50,000 Pacific FundsSM Small-Cap: $10,001 to $50,000 | Over $100,000 |

| Lucie H. Moore | None | None |

| Nooruddin (Rudy) Veerjee | Pacific FundsSM Portfolio Optimization Moderate-Conservative: $10,001 to $50,000 Pacific FundsSM Portfolio Optimization Moderate: $10,001 to $50,000 Pacific FundsSM Portfolio Optimization Growth: $10,001 to $50,000 Pacific FundsSM Portfolio Optimization Aggressive-Growth: $10,001 to $50,000 Pacific FundsSM Floating Rate Income: $10,001 to $50,000 Pacific FundsSM High Income: $10,001 to $50,000 Pacific FundsSM Diversified Alternatives: $10,001 to $50,000 | Over $100,000 |

| James T. Morris | Pacific FundsSM Floating Rate Income: Over $100,000 | Over $100,000 |

| Andrew J. Iseman | None | None |

As of each share class of each Portfolio Optimization Fund assuming implementationApril 5, 2019, for all Funds that have commenced operations, to the best of the new 0.20% annual advisory feeTrust’s knowledge, the Trustees, Nominees and (a) a 0.20% decrease in the annual advisory feeOfficers of the Underlying Funds; (b)Trust as a 0.05% decrease in the annual administration fee; (c) an extension of contractual expense caps through June 30, 2009; and (d) an additional 0.20% decrease in the annual advisory fee for the PL Small-Cap Growth Fund. Fees and expenses are based on average daily net assets of the applicable Fund. Appendix B also includes examples of the costs of investing in the share classes of the Portfolio Optimization Funds under these scenarios.

If approved by Shareholders, the Amended Agreement will become effective on or about July 1, 2008 and, unless sooner terminated, will continue in effect until June 30, 2009. The Amended Agreement will continue for successive one-year terms, provided that such continuation is specifically approved at least annually by a vote of a majority of the Trustees, or by the vote of a majoritygroup beneficially owned less than 1% of the outstanding shares of any Fund share class except for the relevant Portfolio Optimization Fund, and, in either case, by a majority of the Independent Trustees, by vote cast in person at a meeting called for such purpose. The Amended Agreement will terminate automatically in the event of its assignment (as defined in the 1940 Act).

Description of Services Provided Under the Current and Amended Agreements

As stated above, the Current Agreement and the proposed Amended Agreement for each Portfolio Optimization Fund are identical exceptfollowing: with respect to Class I shares of Pacific Funds High Income, the proposed advisory fee change. As a result, the natureTrustees, Nominees and extent of services to be provided to the Portfolio Optimization Funds would be the same under the Amended Agreement as those provided under the Current Agreement. For convenience, the agreements are collectively referred to as the “Advisory Agreements” in the following description.

With respect to the Portfolio Optimization Funds, PLFA’s advisory responsibilities include the following: (i) evaluating the analysis provided by the asset allocation consulting firm and implementing the target allocations; (ii) allocation of daily cash flows to the asset allocation models; (iii) monitoring deviations from the target allocations; and (iv) monitoring the performance of the Portfolio Optimization Funds. A two-step asset allocation process is used to determine the Portfolio Optimization Funds’ investment mix. First, an

6

optimization analysis determines the asset class breakdown using forecasted returns, standard deviations and correlation coefficients of asset classes over the desired investing horizon. Analysis is performed by an asset allocation consulting firm retained by PLFA, which uses a statistical technique known as “mean-variance optimization.” The goal of mean-variance optimization is to identify a mix of asset classes that maximize return for a given level of risk or minimize risk for a given level of return. Second, an evaluation of the Underlying Funds’ asset classes determines the appropriate mix of Underlying Funds to achieve the desired asset class breakdown. It includes historical returns-based style analysis, asset performance, regression and attribution analyses, and portfolio manager interviews. The Underlying Funds that are selected are believed to optimize returns, given each Portfolio Optimization Fund’s risk profile.

After the two-step process is complete, the target allocations are determined. Periodically, PLFA will re-evaluate each Portfolio Optimization Fund’s asset allocation strategy and may update the target allocations at that time. PLFA determines when to rebalance the Portfolio Optimization Funds as market movements move the allocations away from the target allocations or when target allocations are updated. PLFA also determines how to use cash flows in and out of the Underlying Funds in an effort to re-align the Portfolio Optimization Funds within each Underlying Fund’s target allocation. This methodology is intended to help maintain target allocations (although there is no guarantee that the Portfolio Optimization Funds will maintain their target allocations using this methodology). Actual holdings of the Portfolio Optimization Funds could vary from their target allocations due to actual cash flows and changes to the Underlying Funds’ asset values as a result of market movements and portfolio management decisions.

PLFA may change the asset class allocations, Underlying Funds (including any Underlying Fund organized in the future) or target allocations to each Underlying Fund without prior approval from Shareholders as it determines necessary to pursue stated investment goals. Underlying Funds may be added to or deleted from a Portfolio Optimization Fund. Other than to require exclusion of an Underlying Fund that is expected to be liquidated, merged, or otherwise closed, or capacity issues set forth by the portfolio manager, PLFA does not limit the number of Underlying Funds to include in each Portfolio Optimization Fund, the percent that any Underlying Fund represents, or which Underlying Funds may be selected.

In addition, PLFA is responsible for supervising the investment program for each series of the Trust. PLFA also furnishes to the Board, which has overall responsibility for the business and affairsOfficers of the Trust

periodic reports on the investment performance of each series. PLFA monitors the performanceas a group owned approximately 6.85% of the

Underlying Funds, and may, from time to time, recommend tooutstanding shares.Compensation

The following table shows the Board closure, merger, or a change in management firm or strategy of an Underlying Fund, all of which could impact a Portfolio Optimization Fund.

The Current Agreement was last approved by the initial shareholder with respect to the Portfolio Optimization Funds on December 22, 2003 and most recently renewed by the Board at a meeting held on December 4, 2007. Under the terms of the Advisory Agreements, PLFA is obligated to manage the Portfolio Optimization Funds and PL Money Market Fund. Pacific Life, as the Trust’s Administrator, and PFPC Inc., the Sub-Administrator, monitor the Trust’s compliance with the applicable laws and regulations.

Evaluation by the Board

At its meeting on December 4, 2007, the Board, including all the Independent Trustees, approved the Amended Agreement between the Trust and PLFA and recommended that shareholders also approve the Amended Agreement.

The Board noted that the Current Agreement and the Amended Agreement for each Portfolio Optimization Fund are identical except for the proposed advisory fee, that the proposed advisory fee, upon implementation, will be accompanied by an equivalent decrease in the advisory fees of the Underlying Funds, a 0.05% decrease in the annual administration feecompensation paid to the Trust’s

administrator thatIndependent Trustees. Compensation paid by the Fund Complex, which consists of the Trust and Pacific Select Fund, is

appliedfor the fiscal years ended March 31, 2019 and December 31, 2018, respectively. No compensation is paid by the Trust to the

average daily net assetsTrusts’ Officers or the Interested Trustee.| Name | | | Aggregate Compensation from the Trust1 | | | Pension or Retirement Benefits Accrued as Part of the Trust’s Expenses | | | Total Compensation from Fund Complex Paid to Trustees2 | |

| Gale K. Caruso | | | $ | 86,500 | | | N/A | | | $ | 326,500 | |

| Paul A. Keller | | | $ | 92,000 | | | N/A | | | $ | 287,000 | |

| Lucie H. Moore | | | $ | 90,500 | | | N/A | | | $ | 340,500 | |

| Nooruddin Veerjee | | | $ | 97,500 | | | N/A | | | $ | 247,500 | |

| | | | $ | 366,500 | | | N/A | | | $ | 1,201,500 | |

| 1 | No Independent Trustee deferred compensation during the fiscal year ended March 31, 2019. The dollar range of deferred compensation payable to or accrued for Lucie H. Moore was $50,001 to $100,000. Fredrick L. Blackmon, who retired effective March 31, 2019, received aggregate compensation from the Trust of $85,000 for his services as an Independent Trustee for the fiscal year ended March 31, 2019. |

| 2 | Compensation paid by Pacific Select Fund is for the fiscal year ended December 31, 2018 and for the Trust is for the fiscal year ended March 31, 2019. These amounts exclude payments to Fredrick L. Blackmon, who retired effective March 31, 2019. These amounts also exclude deferred compensation, if any, because such amounts were not earned during the relevant periods. |

VOTING REQUIREMENTS

Who has a right to vote on the Proposal?

Shareholders of record at the close of business on April 5, 2019 (the “Record Date”) are entitled to vote on the proposal.

What is the required vote?

This is a Trust-wide vote, meaning that shareholders of all Funds are voting collectively on the proposal. To be elected, provided a quorum is present, each individual standing for election must receive a plurality of the votes cast at the Meeting, meaning the three individuals who receive the most votes across all of the Funds an extension of contractual expense caps through June 30, 2009 for the Funds and an additional 0.20% decrease in the annual advisory fee that is appliedwill be elected to the average daily net assetsBoard. If as expected, no one else stands for the PL Small-Cap Growth Fund. The Board further considered the proposed advisory fee, and the changes to the Trust’s fee structure, in connection with the re-evaluation and re-positioning of the Portfolio

7

Optimization Funds as the primary offering of the Trust as well as changing competitive circumstances. The Board also considered the importance of adjusting the pricing structure of the Portfolio Optimization Funds to be more in line with competing “fund of funds.”

The Board also considered the impact of the fee restructuring on the Underlying Funds. In each case, the Board considered representations from PLFA that its level of service provided to the Funds will not be impacted by the proposed fee restructuring.

In evaluating the Amended Agreement, the Board, including the Independent Trustees, also considered the following factors, among others:

| |

1. | Nature, Extent and Quality of Services |

The Board recognized that PLFA performs advisory services to the Portfolio Optimization Funds and is responsible for the Portfolio Optimization Funds’ asset allocation strategy and target allocations, and incurs advisory expenses at the Portfolio Optimization Funds level. The Board further considered that despite the restructuring of the advisory fees, the level of advisory and/or administrative services currently being provided to the Portfolio Optimization Funds and the Underlying Funds would remain the same. The Board noted that the target allocations, returns and risk characteristics of the Underlying Funds would continue to be monitored by PLFA to maintain the desired risk/return characteristics and asset class and investment style exposure. The Board also took into account that PLFA had tailored applicable policies and procedures to address any potential compliance issues related to the Portfolio Optimization Funds.

The Board considered the depth and quality of PLFA’s investment management process, including its management of the Portfolio Optimization Funds; its experience in asset allocation strategies and management of fund of funds; the experience, capability and integrity of its senior management and other personnel; the low turnover rates of its key personnel; and the overall financial strength and stability of its organization. The Board discussed the high quality of the services provided by PLFA or its affiliates, such as the many educational services and tools to assist intermediaries in effectively understanding and meeting Shareholder needs, and theback-up support that is directly accessible by Shareholders. The Board also considered that PLFA’s investment professionals have access to and utilize a variety of resources and systems relating to investment management, compliance, trading, performance and fund accounting. The Board further considered PLFA’s continuing need to attract and retain qualified personnel and to maintain and enhance its resources and systems.

The Board considered PLFA’s policies, procedures and systems to ensure compliance with applicable laws and regulations and its commitment to those programs; its efforts to keep the Board informed; and its attention to matters that may involve conflicts of interest with each Portfolio Optimization Fund. In this regard, the Board reviewed information throughout the year on PLFA’s compliance policies and procedures, its compliance history, and reports from the Trust’s Chief Compliance Officer on PLFA’s compliance with applicable laws and regulations. The Board additionally reviewed information on any responses by PLFA to regulatory and compliance developments throughout the year.

The Board concluded that it was satisfied with the nature, extent and quality of the investment management services provided by PLFA and that the proposed fee restructuring would not negatively impact these services.

The Board considered investment performance results in light of the Portfolio Optimization Funds’ investment objectives, strategies and risks, as disclosed in the prospectus. The Board also considered the quantitative and qualitative measures used by PLFA to monitor and evaluate investment results of the Portfolio Optimization Funds as well as the Underlying Funds. The Board noted that it received portfolio performance reports from PLFA, which included a detailed description of the Portfolio Optimization Funds’ investment approach, information on the Portfolio Optimization Funds’ gross and net returns and the Portfolio Optimization Funds’ investment performance relative to relevant investment categories and

8

benchmarks. The Board also compared each Portfolio Optimization Fund’s total returns with the total returns of appropriate groups of peer funds based on information provided by PLFA from an outside source, as well as one or more relevant benchmark indices. In particular, the Board reviewed and considered performance information of the Portfolio Optimization Funds’ compared to the respective peer groups over the one- and three-year period ended September 30, 2007.

The Board concluded that PLFA was implementing each Portfolio Optimization Fund’s investment objective and that PLFA’s record in managing each Portfolio Optimization Fund indicates that its continued management will benefit each Portfolio Optimization Fund and its Shareholders. The Board concluded that the proposed fee restructuring will not impact PLFA’s ability to provide Shareholders with acceptable performance results.

| |

3. | Advisory Fees and Total Expense Ratios |

The Board noted that PLFA will not receive any additional aggregate advisory fees and the aggregate fees and expenses borne directly or indirectly by Shareholders will remain the same after the fee restructuring. The Board also considered the future circumstances in which the proposed fee restructuring might actually result in a reduction of the total fees and expenses associated with an investment in the Portfolio Optimization Funds. The Board reviewed the proposed advisory fees as compared to the fees charged by other fund of funds at the asset allocation level from a group of peer funds presented by management. The Board found that, while neither the highest nor the lowest, the proposed advisory fees of the Portfolio Optimization Funds fell within the range of fees reviewed. The Board also reviewed written materials prepared by PLFA based on information retrieved from Morningstar Inc.’s database, which included comparative information about each Portfolio Optimization Fund’s total expense ratios and certain components thereof, relative to those of peer groups presented by PLFA.

In reviewing the proposed fee restructuring, the Board also took into account the equivalent decrease in the advisory fees of the Underlying Funds. The Board considered that the corresponding decrease is intended to assure that adjustments to the Trust’s pricing structure did not impose higher aggregate fees and expenses on Shareholders of the Portfolio Optimization Funds. The Board further considered that the proposed advisory fee also will be accompanied by a 0.05% decrease in the annual administration fee paid to the Trust’s administrator that is applied to the average daily nets assets of the Funds, an extension of contractual expense caps through June 30, 2009 for the Funds and an additional 0.20% decrease in the annual advisory fee paid to PLFA that is applied to the average daily net assets for the PL Small-Cap Growth Fund. The Board noted that the proposal would also benefit existing shareholders of the Underlying Funds who were not invested in the Portfolio Optimization Funds by reducing the Underlying Funds’ advisory and administration fees. The Board also received assurances from PLFA that any reduction in the advisory and administration fees would not result in any reduction in services provided to those Funds.

The Board concluded that the proposed advisory fees and expense ratios were reasonable compared to the advisory fees and expense levels of the other funds in the Portfolio Optimization Funds’ respective peer groups.

| |

4. | Costs, Level of Profits and Economies of Scale |

The Board reviewed information regarding PLFA’s costs of sponsoring the Portfolio Optimization Funds and information regarding the level of profits to be realized by PLFA, if any.

The Board considered the costs of the services to be provided and the overall profitability of PLFA and its affiliates from the management of the Trust. The Board noted that the Funds were not currently profitable due in part to the fact that they have not reached critical mass. The Board also noted that management did not anticipate the Funds becoming profitable in the near-term given the level of subsidy and expense reimbursements provided by PLFA and its affiliates.

The Board also considered that the proposed advisory fee for the Portfolio Optimization Funds would not result in an increase in revenues to PLFA, and considered PLFA’s willingness to reduce the advisory fees of

9

the Underlying Funds. The Board further considered the substantial reimbursements that PLFA and its affiliates have provided to the Portfolio Optimization Funds, that PLFA has agreed to an extension of contractual expense caps through June 30, 2009 for both the Portfolio Optimization Funds and the Underlying Funds and that PLFA has agreed to an additional 0.20% decrease in the annual advisory fee paid to PLFA by the PL Small-Cap Growth Fund. The Board also reviewed information provided during the past year regarding the structure and manner in which PLFA’s investment professionals were compensated and their respective views of the relationship of such compensation to the attraction and retention of quality personnel. The Board considered PLFA’s willingness to invest in technology, infrastructure and staff to reinforce and offer new services and to accommodate changing regulatory requirements.

The Board also noted and considered the extent to which economies of scale may be realized as each Portfolio Optimization Fund grows and whether advisory fee levels reflect economies of scale if each Portfolio Optimization Fund grows in size. The Board noted that the Portfolio Optimization Funds have relatively small asset levels that do not currently produce economies of scale for PLFA. The Board noted, however, PLFA’s commitment to competitive total expenses of the Portfolio Optimization Funds, its consistent reinvestment in the business in the form of improvements in technology and customer service and the fee reductions and expense caps that the Portfolio Optimization Funds’ have been subject to since their inception. The Board concluded that the Portfolio Optimization Funds’ cost structures were reasonable in light of the Trust’s size.

The Board considered a variety of other benefits received by PLFA and its affiliates as a result of their respective relationship with the Portfolio Optimization Funds, including fees for administrative services and reimbursement at cost for support services.

The Board concluded that such benefits were consistent with those generally derived by investment advisers to mutual funds or were otherwise not unusual.

Based on their review, including their consideration of each of the factors referred to above, and assisted by the advice of independent counsel to the Independent Trustees, the Board, including the Independent Trustees, concluded that the Amended Agreement is fair and reasonable to each Portfolio Optimization Fund and its Shareholders, and that the approval of the Amended Agreement is in the best interests of the Portfolio Optimization Funds and their Shareholders. No single factor was determinative of the Board’s decision to approve the Amended Agreement, but rather the Board based its determination on the total mix of information available to them.

Required Vote and Recommendation of the Board

The affirmative vote of a majority of each Portfolio Optimization Fund’s outstanding voting securities (as defined in the 1940 Act) is required to approve the Amended Agreement. The 1940 Act defines a vote of a majority of a fund’s outstanding voting securities as the lesser of (a) 67% or more of the shares representedelection at the Meeting

if more than 50% of the shares entitled to vote are so represented, or (b) more than 50% of the shares entitled to vote. If the required Shareholder approval for each Portfolio Optimization Fundand a quorum is

not obtained, the Current Agreement will remain in effectpresent, Mr. Morris, Mr. Keller and

thereMr. Iseman will be

no implementationelected at the Meeting.How can Shareholders vote on the Proposal?

Shareholders may vote by mail, telephone, Internet or in person. Voting instructions must be received by 6 a.m. Eastern time on June 17, 2019. If you vote by mail, the voting instruction proxy card must be received at the address shown on the enclosed postage paid envelope.

Shareholders may also vote by attending the Meeting in person. To attend the Meeting in person, you will be required to provide proof of ownership of an advisory fee for any Portfolio Optimization Fund and no corresponding decreaseinterest in the advisory feesFund(s) and a valid form of the Underlying Funds; and there may notidentification, such as a driver’s license, passport or other government-issued ID.

How will votes be a decrease in the Administration Fee, an extension of the contractual expense caps through June 30, 2009 and an additional decrease in the advisory fee for the PL Small-Cap Growth Fund.

If approvedcounted?Shares represented by Shareholders of each Portfolio Optimization Fund, this proposal will take effect onproperly executed proxies, unless revoked before or about July 1, 2008.

10

The Board unanimously recommends that Shareholders voteFORthe approval of the Amended Agreement.

OTHER MATTERS

Other Matters

The Board knows of no other business to be brought beforeat the Meeting, other than as set forth above. If, however, any other matters properly come beforewill be voted according to the Meeting, it is the intention of the persons named in the enclosed form of proxy to vote on such matters in accordance with their best judgment.

Voting Information

General

Shares held by Shareholders present in person or represented by proxy at the Meetingshareholder’s instructions, and will be counted both for the purpose of determining the presence of a quorum and for calculating the votes cast on

the proposal. Each whole share will be entitled to one vote and each fractional share will be entitled to a proportionate fractional vote. Shares have noncumulative voting rights. The number of outstanding shares for each Fund as of the Record Date is as listed inExhibit C. Each person that, to the knowledge of the Funds, owned beneficially or of record 5% or more of the outstanding shares of any

Fund as of the Record Date is listed inExhibit D.Funds of Funds of the Trust, as shareholders of underlying Funds, will vote their proxies for underlying Fund sharesin the same proportion as the votes cast on the proposal beforeby the Meeting. Shares representedshareholders of the Funds of Funds. For example, Pacific Funds Portfolio Optimization Conservative will vote its shares of the PF Inflation Managed Fund in the same proportion as the votes cast on the proposal by timelythe shareholders of Pacific Funds Portfolio Optimization Conservative. Similarly, Pacific Funds Portfolio Optimization Conservative will vote its shares of Pacific Funds Core Income, another underlying Fund, in the same proportion as the votes cast on the proposal by the shareholders of Pacific Funds Portfolio Optimization Conservative.

Broker-dealer firms holding shares in “street name” for the benefit of their customers will request the instructions of such customers on how to vote their shares on the proposal. Pursuant to the rules and policies of the New York Stock Exchange (“NYSE”), broker-dealers that are members of the NYSE that have not received instructions from their customers (or “broker non-votes”) may vote on the proposal without instructions from beneficial owners of the Trust’s shares.Broker non-votes will be excluded from any vote to adjourn the Meeting and, accordingly, will not affect the outcome of an adjournment vote.

A properly executed voting instructions willproxy card or other authorization by a customer that does not specify how the shares should be voted as specified. Executed voting instructions that are unmarked willon the proposal may also be voted in favor of the proposals set forthproposal. In this context, voting in favor of the Notice.

proposal means voting for all of the Nominees.How will “Withhold” votes be treated?

“Withhold” votes will be counted as present for purposes of determining whether a quorum is present at the Meeting, and assuming a quorum is present, will have no effect on the proposal.

How can a vote be changed?